Does your business involve cooperation with European companies? In some cases, it may be required to provide foreign partners with various accounting documents.

If the preparation and submission of reports is outsourced, you can use the additional service of apostille or legalization of documents for use in the EU.

It should be noted that the apostille is sufficient in cases where financial statements and other documentation are transferred to a country that has signed the Hague Convention. The apostilled document will have legal force, which ensures its recognition by the controlling organizations of the European state.

When is the apostille issued?

Accounting services, including apostille of documents, can be relevant both at the start of a business and with its successful running, development, entering the European market, searching for suppliers, buyers, business partners. When it comes to reporting, it is most often provided in Europe:

potential and current investors;

financial institutions (banks);

government agencies;

representative offices of Russian companies abroad.

The statements subject to apostille may contain various data. It displays the availability and amount of financial and other material resources of the company, the results of its commercial activities, etc. Apostille of reporting for the provision of documents to foreign partners serves as proof of the seriousness of the intentions of the Russian company, its reliability, readiness to work on transparent terms and strictly within the framework of the current domestic legislation, international industry (profile) regulations.

What is apostille?

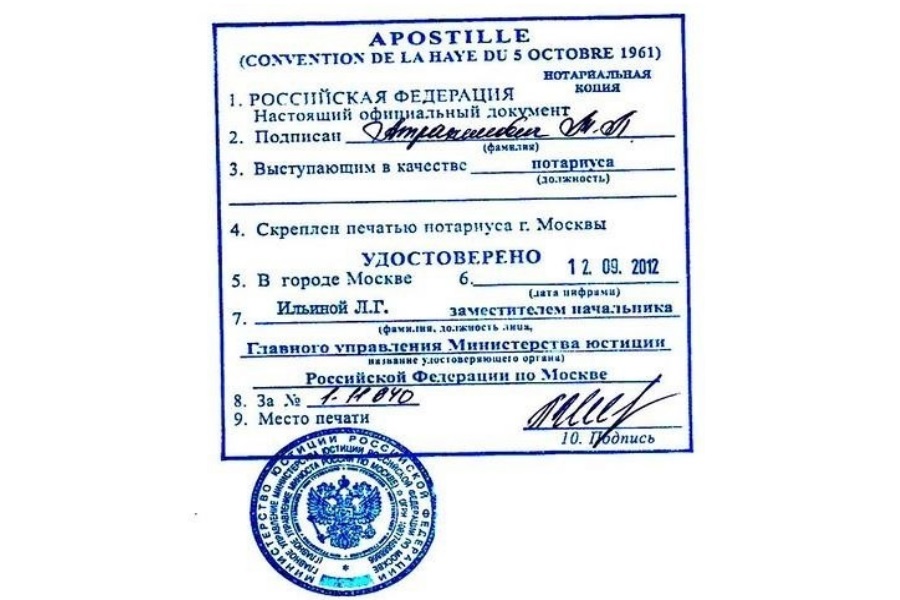

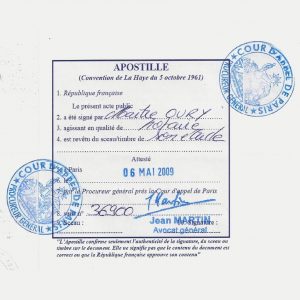

Apostille is often called a document. In fact, it is a standard stamp, in the field of which data is indicated. The apostille is drawn up in the language of the state in which the document to be apostilled will be used.

A square standard stamp is affixed on the originals of legalized documents, as well as on sheets that are annexes to them. To apostille the financial statements, you must contact the Ministry of Justice.

Peculiarities of obtaining an apostille: procedural nuances and possible risks

Apostille is affixed only to documents that meet certain requirements. They should be:

original, intact (the presence of damages on the sheets may cause a refusal to apostille);

without additional protection (lamination);

no fixes;

free of defects such as scuffs, stains that make it difficult to read the text.

It is also important to correctly execute the documents to be apostilled. When it comes to reporting, each form must be filled out accordingly, signed by specific officials.

Verification of accounting documents before apostille, their submission to the Ministry of Justice can be controlled independently and transferred to outsourcing. In the latter case, the customer gets the opportunity to minimize legal risks, optimize the time spent on legalizing documents.

Apostille is the simplest form of confirmation of the authenticity of accounting documents intended for use in another country. But the standard stamp is not always enough. If the documentation is used in a country that has not signed the Hague Convention, it will have to be legalized in a standard way: through the Ministry of Justice, the Ministry of Foreign Affairs, the consulate.